Are you tired of the daily grind and dreaming of a life where you can earn money while you sleep? Many people are on the lookout for passive income ideas that can help them achieve financial freedom and enjoy more time for the things they love.

Imagine waking up to find your bank account has grown overnight, all thanks to some time you invested upfront.

That’s the beauty of passive income—it allows you to build wealth without constantly trading your time for money.

The opportunities for generating passive income are more diverse and accessible than ever, but some of these passive income streams are easier to obtain and manage than others.

Some require an upfront investment of either time or money and some are riskier than others, but rest assured there is something in here for everyone.

What is Passive Income?

Before we get into how to generate passive income, let’s discuss what it is exactly (and what it’s not).

Some define passive income as the money you earn with little to no effort on your part after the initial setup, but I don’t think this is a good definition because some passive income ideas do require some ongoing maintenance.

I think a better definition of passive income is simply revenue that doesn’t require you to trade a specific dollar amount for your time spent, like a traditional 9-to-5 job.

It’s often referred to as money made “while you sleep,” because sales and revenue can be generated without you having to do anything.

Here are some common examples of passive income ideas:

- Rental income

- Blog income

- Investment income

- Digital product sales

Earning passive income means you can focus on other pursuits, whether that’s spending time with family, traveling, or even starting a new venture.

The beauty of generating this type of income lies in its potential for financial freedom. By creating multiple income streams, you can build wealth over time and reduce your reliance on a single source of income.

While the idea of earning money while you sleep is enticing, it’s essential to understand that most passive income streams require an upfront investment of time, effort, or capital. However, once established, these income sources can provide ongoing financial benefits, allowing you to enjoy a more flexible lifestyle.

Importance of Diversifying Passive Income

Just as you wouldn’t put all your eggs in one basket, it’s crucial not to rely on a single passive income stream.

Diversifying your passive income portfolio is a smart strategy that can lead to greater financial stability and growth.

For example, if you rely solely on rental income and face a period of vacancy, having additional streams like dividend stocks or affiliate marketing can help offset the temporary loss.

Here’s why it’s so important:

- Risk Mitigation: By spreading your investments across multiple passive income sources, you reduce the impact of any single stream underperforming. If one income source falters, others can help maintain your overall financial health.

- Increased Earning Potential: Tapping into various markets and income types can potentially increase your overall earnings as different income streams may perform well at different times or reach different limits of earnings.

- Adaptability to Market Changes: Different passive income streams may react differently to economic shifts. A diversified portfolio allows you to adapt more easily to changing market conditions.

- Leveraging Different Skills and Interests: This allows you to capitalize on various skills and interests you may have, can make the process more enjoyable, and can also increase your chances of success in different areas.

- Scalability and Growth: Multiple income streams provide you with more opportunities to reinvest and scale. As one stream becomes more established, you can use its proceeds to grow another or explore new passive income ideas.

- Tax Efficiency: Different types of passive income may be taxed differently. By diversifying, you can potentially optimize your tax situation, taking advantage of various deductions and lower tax rates associated with certain types of passive income.

While diversification is key, it’s also important to avoid spreading yourself too thin. Start with a few well-researched passive income ideas that align with your skills, interests, and financial goals.

As you gain experience and your income grows, you can gradually expand your portfolio.

33 Diverse Passive Income Ideas to Try

The passive income ideas below are categorized based on the type of income (i.e. online, investment, real estate, etc.).

Online Passive Income Ideas

1. Affiliate Marketing

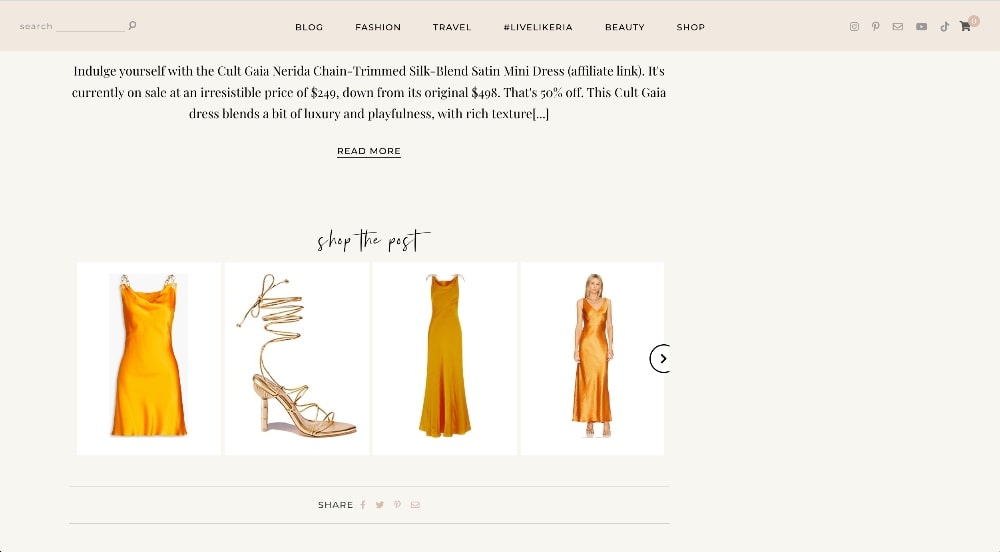

Affiliate marketing is a popular and effective way to earn passive income by promoting products or services from other companies. As an affiliate, you share unique referral links on your blog, social media, or website, and when someone makes a purchase through your link, you earn a commission.

This model allows you to make money selling products and services without the hassle of managing inventory or customer service.

All you need to make money with affiliate programs is a traffic source or channel to market the products that you’re selling (i.e. YouTube, podcast, blog, Instagram, Facebook, Pinterest, etc.)

Some popular affiliate marketing networks include:

Making money as an affiliate marketer is fairly easy once you get the hang of creating the content that sells the products and putting it in front of the right audience.

I have been able to make over $50,000/month with affiliate marketing with this blog.

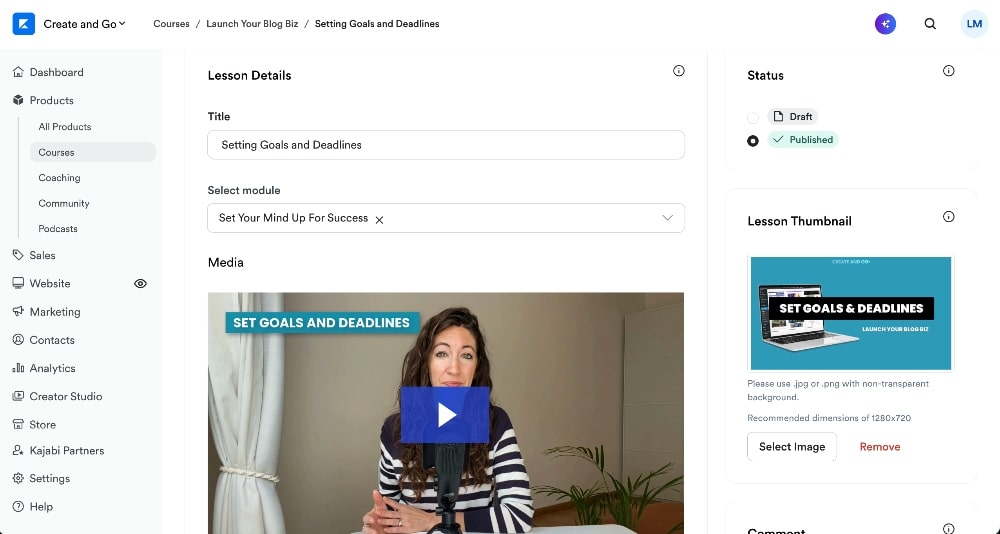

2. Create and Sell Online Courses

Creating and selling online courses is one of my favorite ways to generate passive income. It’s also where a large portion of the revenue that this blog earns comes from.

If you have knowledge in a particular field—be it cooking, photography, coding, or personal finance—you can package that knowledge into a structured course format.

The beauty of creating an online course is that once it’s created, it needs very little upkeep other than to make sure you keep it updated for your students or future students.

There are two ways to get started with courses:

- Easy approach: Sell courses on a marketplace platform like Udemy or Skillshare that drives traffic and an audience for you (most passive but competitive with lower earning potential).

- Longer approach: Sell courses on a course creation platform like Teachable or Kajabi and drive your own traffic or audience (requires building an audience and marketing your course, but higher earning potential).

We have experience in both approaches and can recommend both, depending on how much time you have or want to invest.

3. Start a Blog

Blogging might seem so 2010, but trust me, it’s still a powerful passive income generator today! We would know, it’s how we make most of our passive income.

You can make money blogging various channels, including ads, affiliate marketing, sponsored content, and selling your own products or services (eBooks, coaching, courses, consulting, etc.).

To start a successful blog, you should choose a niche around a topic you have knowledge about or are passionate about. From there, you create content for a specific audience you want to reach and then share that content on your blog and other social media channels.

While starting a blog has the potential to make passive income for years to come, blogging is also a long game.

It might take several months before you start seeing significant income, but with persistence and quality content, you can build a loyal following and a steady stream of passive income.

4. Create a YouTube Channel

With billions of active users, YouTube offers a vast platform for content creators to reach audiences interested in a wide array of topics, from cooking and travel to technology and education.

The key to success lies in finding a niche that aligns with your interests and expertise, allowing you to create authentic and valuable content.

Once your channel gains traction and builds a subscriber base, you can monetize your videos through various means, including ad revenue from the YouTube Partner Program, sponsorships from brands, and affiliate marketing opportunities.

Read more: How to Start a YouTube Channel: Ultimate Guide to Success

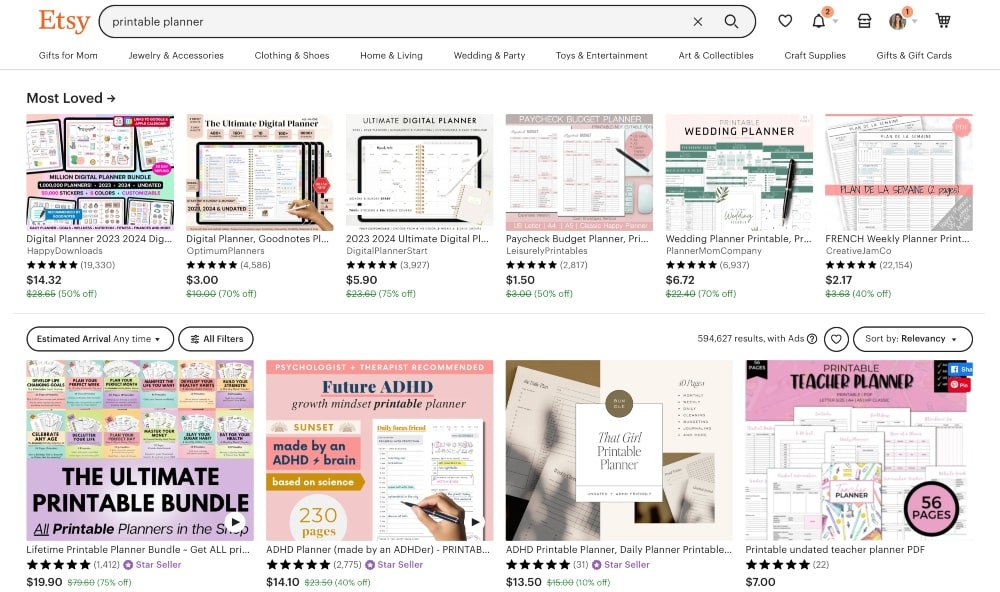

5. Sell Digital Products

Digital products encompass a wide range of offerings, including eBooks, online courses, templates, graphics, and more.

The appeal of digital products lies in their ability to provide value to customers while requiring minimal ongoing effort after the initial creation.

Selling products on marketplaces like Etsy or Amazon allows you to leverage your creative skills and set up a passive income stream that can pay you far beyond your initial launch.

We’ve sold an eBook on Amazon in the past and earned an extra $2,000 or so a month from the side project.

Read more: How to Create an eBook in 4 Simple Steps

6. Create and Monetize a Podcast

Creating and monetizing a podcast can be an exciting and rewarding project that allows you to share your thoughts, energy, and passion while generating income.

This medium provides a unique opportunity to connect with an audience on a personal level, fostering a sense of community around shared interests.

Once you’ve built an audience, there are several ways to monetize your podcast:

- Sponsorships and advertising are popular methods, where companies pay you to promote their products or services during your episodes.

- Affiliate marketing allows you to earn commissions by recommending products to your listeners.

- Offering premium content or exclusive episodes to paying subscribers can create a recurring revenue stream.

- Crowdfunding through platforms like Patreon enables your most dedicated fans to support your show financially.

- Selling merchandise related to your podcast can be an additional revenue source.

- Using your podcast to promote your own products or services is another effective strategy.

Read more: How to Start a Successful Podcast: Easy Step-by-Step Guide

7. Make Money With TikTok

TikTok has rapidly emerged as a lucrative platform for creators to generate income through engaging content.

One of the primary ways to earn money is by joining the Creator Rewards Program, which compensates creators based on video performance. As your following grows, you can also collaborate with brands for sponsored content, promoting products that align with your style and audience.

You can also use your TikTok audience to promote affiliate products or even sell your own products or merchandise.

Here’s an example of how Laura Beverlin uses TikTok to promote and sell her line of sunglasses:

@laurabeverlin We’re goving 3 of you the entire Beverlin x DIFF collection 🕶️ I put the link in my bio. Winners picked tomorow! 👏🏽 #new #summer #sunglasses #lifestyle @DIFF Charitable Eyewear #trending #fyp ♬ original sound – Laura Beverlin

With TikTok’s e-commerce features, you can even set up a shop directly on the platform, making it easier for followers to purchase products showcased in your videos.

8. Sell Stock Photos or Videos

Selling stock photos or videos is a fantastic way to turn your photography or videography skills into a passive income stream.

With the growing demand for high-quality visual content across various industries, platforms like Shutterstock, Adobe Stock, and iStock provide excellent opportunities for creators to monetize their work.

Each time someone purchases your work, you earn a royalty, allowing you to generate revenue passively over time. Additionally, as you build a portfolio and gain visibility on these platforms, your chances of making consistent sales increase.

While it may take time to establish your presence and see significant earnings, selling stock photos or videos can be a rewarding way to leverage your creative talents and create a sustainable source of passive income.

9. Open an E-commerce Store

Companies like Shopify have made it easier than ever to open an e-commerce store and partner fulfillment services that even take care of the inventory for you.

With print-on-demand services like Printify and Printful, you can design and sell custom products without ever even touching the product yourself (except order samples, of course).

When a customer places an order, the product is printed and shipped directly to them. This eliminates the need for upfront inventory costs and storage space. Popular print-on-demand products include t-shirts, mugs, phone cases, and wall art.

You can build an audience on social media for the products that you sell or capitalize on the passive route by selling on established marketplaces like Amazon and Etsy.

These platforms already have a built-in customer base and handle much of the marketing for you. By optimizing your product listings and leveraging the platform’s tools, you can increase visibility and sales without constant active management.

Print-on-demand can be competitive but if your product stands out or keyworded well for search, it can be a great passive income strategy.

10. Start a Dropshipping Business

Another way to sell products online without handling inventory or shipping is called dropshipping. When you sell a product with dropshipping, the product is actually purchased from a third-party supplier who then ships it directly to the customer.

This differs from traditional e-commerce stores in that the products are already established by the third-party sellers – compared to print-on-demand where the product is actually designed by you and created by a fulfillment center when it’s ordered.

All you have to do is choose an e-commerce platform like Shopify.com or BigCommerce.com to create a shop and then you integrate it with dropshipping apps like Oberlo or Spocket.

11. Create an App

Developing a successful app can be a lucrative source of earning some passive cash, offering potential earnings through downloads, in-app purchases, or advertising revenue.

If you think this interests you, try to identify a problem or need that your app can address, and research the market to ensure demand. Platforms like SensorTower can provide valuable insights into app market trends and competition.

For app development, you can either learn coding through resources like Udacity or Coursera, or hire developers through platforms like Upwork or Toptal. Consider using app development frameworks like React Native or Flutter to create cross-platform apps efficiently.

Once developed, list your app on major app stores like Google Play and Apple’s App Store. Remember to budget for ongoing costs like server hosting and customer support to ensure long-term success.

Investment-Based Passive Income Ideas

12. High-Yield Savings Accounts

Opening a high-yield savings account can provide a safe and liquid way to earn passive income. These accounts typically offer interest rates significantly higher than traditional savings accounts, allowing your money to grow faster with virtually no risk.

They are ideal for short-term savings goals or emergency funds, as they provide easy access to your money without penalties.

While the returns may not be as high as other investment options, the security and liquidity make high-yield savings accounts a valuable component of a diversified financial strategy.

Look for accounts with no monthly fees and competitive interest rates to maximize your earnings while maintaining easy access to your funds.

I have a high-yield savings account (no fees) with both American Express and CIT Bank and can recommend both.

13. Dividend-Paying Stocks

Investing in dividend-paying stocks allows you to earn regular income from established companies. These firms distribute a portion of their profits to shareholders, providing a fairly consistent source of passive income.

While the returns may not match those of growth stocks, dividend stocks offer stability and potential for long-term appreciation.

Many investors reinvest dividends to purchase more shares, compounding their returns over time.

When selecting dividend stocks, consider the company’s financial health, dividend history, and payout ratio to ensure sustainable income.

This strategy can be particularly appealing for retirees or those looking to supplement their income without selling their investments.

14. Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) allow you to invest in real estate without directly owning properties. These companies own and manage income-producing real estate, such as shopping malls, office buildings, and apartment complexes.

By law, REITs must distribute at least 90% of their taxable income to shareholders as dividends, making them an attractive option for passive income.

Investing in REITs offers diversification and the potential for both income and capital appreciation.

You can purchase shares of publicly traded REITs through a brokerage account, making it easy to add real estate exposure to your investment portfolio without the complexities of property management.

A couple of great resources to help you learn more about how to get started are Nareit and REITNotes.

15. Peer-to-Peer Lending

Peer-to-peer lending platforms (P2P), such as Prosper and LendingClub, connect borrowers with individual lenders. By lending money directly to individuals or small businesses, you can earn interest rates often higher than traditional savings accounts or bonds.

P2P lending allows you to diversify your investments by spreading your capital across multiple loans, reducing the risk associated with any single borrower defaulting.

However, it’s essential to assess the creditworthiness of borrowers and understand the potential risks involved. While P2P lending can offer attractive returns, it also carries the risk of borrower defaults, so careful consideration and diversification are crucial for success.

16. Index Funds and ETFs

Index funds and exchange-traded funds (ETFs) offer broad market exposure and diversification, making them popular choices for passive investors.

By investing in a basket of stocks or bonds that mirror a specific index, such as the S&P 500, you can benefit from overall market growth while minimizing the risks associated with individual securities.

Many index funds and ETFs also pay dividends, providing an additional source of passive income. These investment vehicles typically have lower fees than actively managed funds, which can enhance overall returns.

By incorporating index funds or ETFs into your portfolio, you can achieve long-term growth with a hands-off approach to investing.

Vanguard and iShares are a couple of great places to get started.

17. Mutual Funds and Money Market Funds

Mutual funds and money market funds offer relatively low-risk options for generating passive income through diversified investment portfolios.

- Mutual funds pool money from multiple investors to invest in a variety of securities, including stocks, bonds, and other assets.

- Money market funds, a type of mutual fund, invest in short-term, high-quality debt instruments.

To get started, explore fund options on platforms like Vanguard or Fidelity. For research and comparisons, visit Morningstar.com or Zacks.com.

Success with these funds often comes from choosing those with low expense ratios and consistent performance over time. While generally considered lower risk than individual stocks, returns can vary based on market conditions and fund management.

18. Bonds and Bond Funds

Bonds are fixed-income securities that provide regular interest payments and return the principal upon maturity. They can be a stable source of passive income, especially for risk-averse investors.

Bond funds, which pool money from multiple investors to buy a diversified portfolio of bonds, offer an easy way to gain exposure to fixed-income investments while reducing individual bond risk.

While bonds generally provide lower returns compared to stocks, they can act as a stabilizing force in a diversified portfolio.

When investing in bonds or bond funds, consider factors such as interest rates, credit quality, and duration to align your investments with your financial goals and risk tolerance.

Read more: How to Invest in Bonds and Bond Mutual Funds

19. Cryptocurrency Staking

Cryptocurrency staking is a process that allows you to earn passive income by holding and “staking” certain cryptocurrencies.

By participating in the staking process, you help maintain the network’s security and operations, and in return, you receive rewards in the form of additional cryptocurrency.

This method can be particularly appealing for long-term holders of cryptocurrencies like Ethereum or Cardano, which use proof-of-stake mechanisms.

While staking can provide attractive returns, it’s essential to understand the risks involved, including market volatility and the potential for loss.

Read more: Beginner’s Guide to Staking Crypto

20. Invest in Startups through Crowdfunding Platforms

Investing in startups through crowdfunding platforms like StartEngine allows you to support early-stage companies while potentially earning significant returns.

These platforms enable you to invest in businesses that align with your interests, often with relatively low minimum investment amounts.

While investing in startups carries a higher risk due to the potential for failure, it can also offer the chance for substantial rewards if the company succeeds.

Thorough research is crucial when considering investments in startups, as understanding the business model, market potential, and management team can help mitigate risks. Diversifying your investments across multiple startups can further enhance your chances of success in this exciting investment landscape.

Real Estate Passive Income Ideas

21. Rental Properties

Investing in rental properties can help you build passive income through monthly rent payments.

While it requires initial capital and ongoing management, an investment property offers the potential for long-term appreciation and tax benefits.

To minimize active involvement, consider hiring a property management company to handle tenant screening, maintenance, and rent collection. Websites like Roofstock and Zillow can help you find suitable investment properties.

For property management services, check out Mynd or RealPage. Success in rental property investing often depends on choosing the right location, understanding local real estate markets, and maintaining properties to attract and retain quality tenants.

22. Airbnb and Short-Term Rentals

Short-term rentals through platforms like Airbnb can potentially generate higher income than traditional long-term rentals, especially in popular tourist destinations.

This strategy allows for flexibility in pricing based on seasonal demand and events.

To get started, list your property on Airbnb or VRBO. Consider using management services to handle guest communications, cleaning, and maintenance, making it a more passive investment.

Be sure to check local regulations regarding short-term rentals, as some areas have restrictions or require special permits.

23. Real Estate Crowdfunding

Real estate crowdfunding platforms allow you to invest in real estate projects without the responsibilities of property ownership. These platforms pool money from multiple investors to fund various real estate ventures, from commercial properties to residential developments.

Two popular platforms for this include Fundrise and RealtyMogul.

This approach offers the potential for passive income through dividends and property appreciation, with lower minimum investments compared to direct property ownership.

However, it’s important to research each platform and investment opportunity thoroughly, as returns can vary, and some investments may have longer lock-up periods.

24. Storage Unit Rentals

Investing in storage units can be a low-maintenance way to build passive income. With increasing urbanization and downsizing trends, demand for storage space continues to grow.

Websites like LoopNet and StorageMart offer opportunities to invest in existing storage facilities or develop new ones.

You can also explore self-storage REITs like Public Storage (NYSE: PSA) for a more hands-off approach.

Success in storage unit rentals often comes from choosing good locations, implementing efficient management systems, and providing secure, clean facilities.

Consider factors like local competition, population growth, and average incomes when selecting locations for storage unit investments.

25. Parking Space Rentals

Renting out parking spaces can be a simple yet effective way of making passive income, especially in urban areas with limited parking.

If you own property with extra parking spaces or live in an area with high parking demand, consider listing your spots on platforms like SpotHero or JustPark.

In some cases, you may need to obtain permits or insurance for commercial parking operations.

Business-Related Passive Income Ideas

26. Vending Machines

Vending machines offer a relatively hands-off way to generate passive income. Once installed in high-traffic locations, these machines can provide a steady stream of revenue with minimal daily involvement.

To get started, research vending machine suppliers like VendingGroup or UselectIt.

Consider various types of vending machines, from snacks and beverages to specialty items like electronics or health products. Success depends on choosing profitable locations, maintaining a reliable inventory, and ensuring regular maintenance.

While you’ll need to restock and collect money periodically, many modern vending machines offer remote monitoring capabilities, allowing you to track sales and inventory levels from your smartphone.

Be prepared for an initial investment in machines and products, and research local regulations regarding vending machine operations.

27. Laundromats

Laundromats can be an excellent source of passive income, especially in urban areas or near college campuses. Once set up, they require minimal daily oversight.

To explore laundromat opportunities, check out websites like BizBuySell or LaundryMart.

Consider partnering with a laundry equipment supplier like Speed Queen or Dexter Laundry for machine purchases and maintenance support.

While you’ll need to handle periodic maintenance and money collection, many modern laundromats feature card-operated machines and remote monitoring systems, reducing the need for constant on-site presence.

28. Car Wash Businesses

Automated car washes can provide a steady stream of passive income with relatively low labor costs. To explore car wash opportunities, visit websites like CarWashCountry or CarWash.

Consider investing in modern, eco-friendly equipment from suppliers like PDQ or Washworld to attract environmentally conscious customers.

While some oversight is necessary for maintenance and restocking supplies, many modern car washes feature automated payment systems and remote monitoring capabilities.

Be prepared for a significant initial investment in equipment and property, and research local zoning laws and environmental regulations before starting your car wash business.

29. ATM Machines

Owning and operating ATM machines is one of the more lucrative passive income ideas on this list. Place ATMs in high-traffic areas like convenience stores, bars, or event venues to maximize usage.

To get started, explore ATM suppliers and processors like ATMDepot. Consider both purchasing and leasing options for ATM machines.

While you’ll need to refill cash periodically, many modern ATMs offer remote monitoring capabilities, allowing you to track transactions and cash levels remotely.

Be aware of compliance requirements, including ADA regulations and security measures. Also, research transaction fee structures to ensure profitability while remaining competitive in your chosen locations.

Miscellaneous Passive Income Ideas

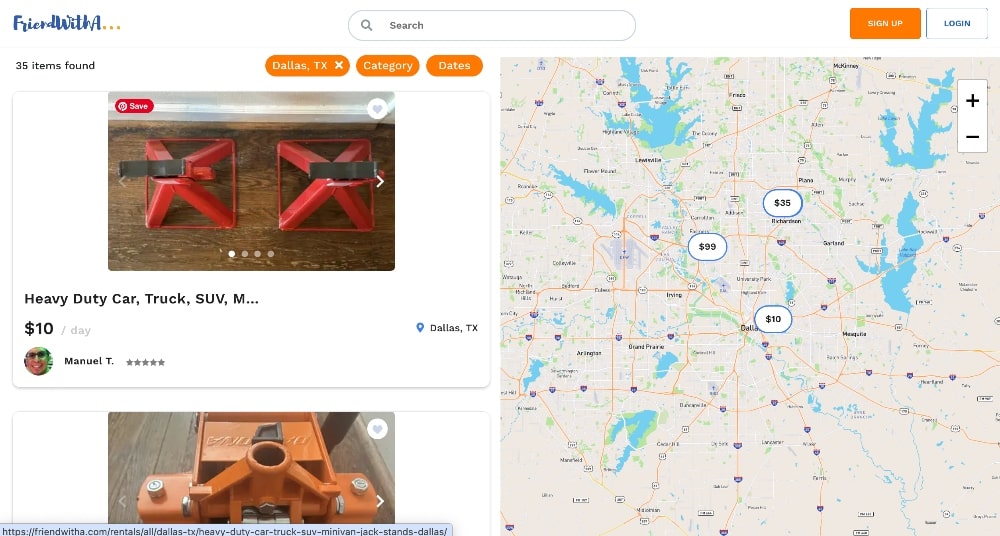

30. Rent Out Equipment or Tools

Renting out equipment or tools you own can be a great way to earn rental income from items that might otherwise sit idle. Popular items to rent include power tools, lawn care equipment, cameras, and camping gear.

Platforms like FriendWithA and RentItToday allow you to list your items for rent.

Make sure to create clear rental agreements and consider insurance options to protect your assets.

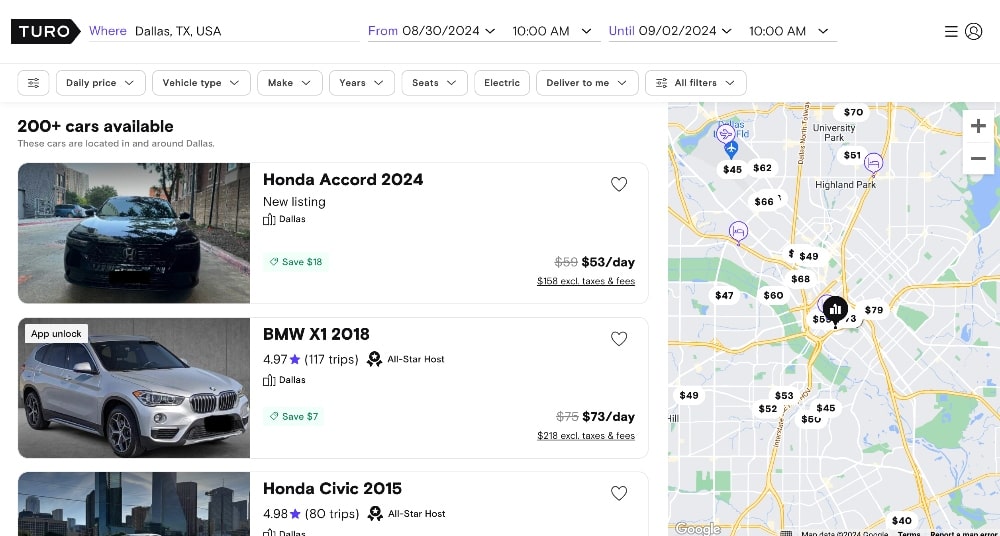

31. Rent Out Your Car or RV

Turning your vehicle into a source of passive income is easier than ever with peer-to-peer car-sharing platforms.

For cars, consider listing on Turo or Getaround. If you own an RV, platforms like RVshare and Outdoorsy cater specifically to recreational vehicle rentals.

Make sure to check local regulations regarding peer-to-peer vehicle rentals, as some areas have specific requirements or restrictions.

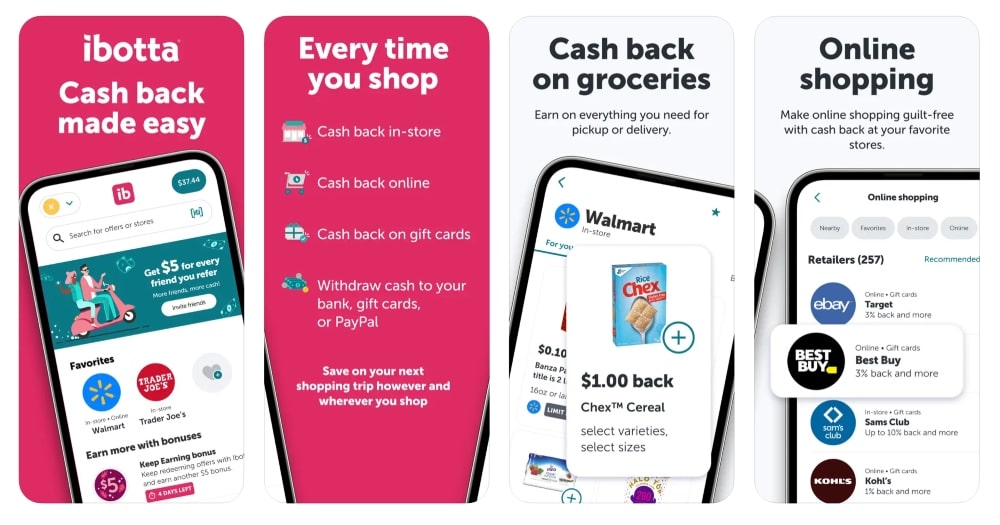

32. Cashback Credit Cards and Apps

Cashback credit cards and apps offer an easy way to earn passive income on purchases you’re already making.

For credit cards, compare offers on sites like NerdWallet or CreditCards to find the best cashback rates for your spending habits.

Popular cashback apps include Rakuten, Ibotta, and Dosh, which offer rebates on online and in-store purchases.

To maximize your earnings, use a combination of cashback credit cards and apps, and consider stacking rewards when possible.

While the income may seem small at first, it can add up significantly over time, especially if you’re strategic about your spending.

Remember to pay off credit card balances in full each month to avoid interest charges that could negate your cashback earnings.

33. Rent Out Advertising Space (Physical or Digital)

Renting out advertising space, whether physical or digital, can be a lucrative passive income stream. For physical spaces, consider renting out billboards, vehicle wraps, or space on your property for signage.

Websites like BlipBillboards and Carvertise offer opportunities in these areas.

For digital advertising, if you have a website or popular social media account, you can monetize your traffic through platforms like Google AdSense or direct partnerships with brands.

FAQs about Passive Income Ideas

Conclusion

The pursuit of passive income has become increasingly appealing as individuals seek financial freedom and the ability to enjoy life without the constraints of a traditional 9-to-5 job.

From real estate investments and money market accounts to innovative online ventures like app development and dropshipping, there are countless opportunities to generate income with minimal ongoing effort.

By exploring various passive income ideas and choosing the ones that align with your interests and skills, you can create a diversified income stream that enhances your financial stability.

Remember, while many passive income strategies require an initial investment of time, money, or effort, the long-term benefits can be substantial. Make sure to also stay informed, remain adaptable, and be prepared to invest in your education and skills.

With dedication and the right approach, you can achieve your financial goals and enjoy the freedom that comes with a well-established passive income portfolio.